Mortgage for Second Home Calculator

Mortgage for Second Home Calculator

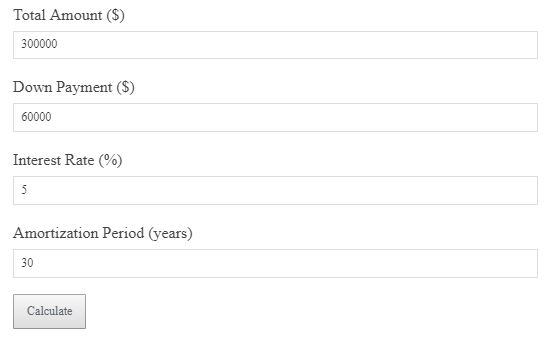

Calculate your potential monthly mortgage payments for purchasing a second home.

Not calculated yet.

Home Price: ${formatCurrency(homePrice)}

Down Payment: ${formatCurrency(downPayment)}

Interest Rate: ${(interestRate * 100).toFixed(2)}%

Loan Term: ${loanTerm / 12} years

`; mortgageSteps += `Formulas:

Loan Amount = Home Price – Down Payment

Monthly Payment = Loan Amount × Monthly Interest Rate / (1 – (1 + Monthly Interest Rate)^(-Loan Term))

`; mortgageSteps += `Results:

Estimated Monthly Payment: ${formatCurrency(monthlyPayment)}

`; if(document.getElementById(“calculationStepsMortgage”).style.display===”block”){ document.getElementById(“calculationStepsMortgage”).innerHTML = mortgageSteps; } } function resetMortgage(){ document.querySelectorAll(“#secondHomeMortgageCalculator input”).forEach(el=>el.value=””); mortgageSteps=””; document.getElementById(“calculationStepsMortgage”).innerHTML=”

Not calculated yet.

“; } function toggleMortgageSteps(){ const s=document.getElementById(“calculationStepsMortgage”); const a=document.getElementById(“toggleArrowMortgage”); if(s.style.display===”none”||s.style.display===””){ s.style.display=”block”;a.style.transform=”rotate(180deg)”; s.innerHTML=mortgageSteps||”Not calculated yet.

“; }else{s.style.display=”none”;a.style.transform=”rotate(0deg)”;} } function formatCurrency(n){return currencySymbol+n.toFixed(2)+” “+fixedCurrency;}This mortgage for second home calculator helps you estimate the monthly payments on a mortgage loan for purchasing a second home. Enter the home price, down payment, interest rate, and loan term to find out your potential monthly mortgage payment.

- Second home mortgage payment estimator

- Second home loan affordability calculator

- Mortgage payment breakdown tool

- Home loan comparison tool

Mortgage Payment Formula

Monthly Payment = Loan Amount × Monthly Interest Rate / (1 – (1 + Monthly Interest Rate)^(-Loan Term))

Example Calculation

For a second home price of $300,000, with a $60,000 down payment, a 3.5% interest rate, and a 30-year loan term, the monthly payment would be calculated accordingly.

Why It Matters

Knowing your monthly payment helps you plan your budget and understand the affordability of your second home.

Smart Strategy

Ensure that your second home mortgage payment is within your budget and doesn’t stretch your finances.

FAQs

Can I get a mortgage for a second home? Yes, many lenders offer mortgages for second homes, but the terms may differ from your primary residence mortgage.

What is the down payment required for a second home? Typically, a 20% down payment is required for second homes, though some lenders may offer different terms.

How long is the loan term for a second home mortgage? The loan term for second homes is often 15 to 30 years, depending on the lender and your financial situation.