Calculator Mortgage Refinance Second Home

Mortgage Refinance Second Home Calculator

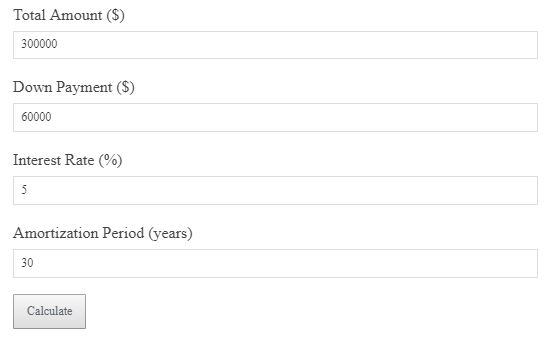

Estimate your new mortgage payment when refinancing a second home.

Not calculated yet.

Loan Amount: ${formatCurrency(loanAmount)}

Interest Rate: ${(interestRate * 100 * 12).toFixed(2)}%

Loan Term: ${loanTerm / 12} years

`; mortgageSteps += `Formula:

Monthly Payment = (Loan Amount × Interest Rate) / (1 – (1 + Interest Rate)^(-Loan Term))

`; mortgageSteps += `Result:

Estimated Monthly Payment: ${formatCurrency(monthlyPayment)}

`; if(document.getElementById(“calculationStepsMortgage”).style.display === “block”){ document.getElementById(“calculationStepsMortgage”).innerHTML = mortgageSteps; } } function resetMortgage(){ document.querySelectorAll(“#calculator input”).forEach(el => el.value = “”); mortgageSteps = “”; document.getElementById(“calculationStepsMortgage”).innerHTML = “

Not calculated yet.

“; } function toggleMortgageSteps(){ const s = document.getElementById(“calculationStepsMortgage”); const a = document.getElementById(“toggleArrowMortgage”); if(s.style.display === “none” || s.style.display === “”){ s.style.display = “block”; a.style.transform = “rotate(180deg)”; s.innerHTML = mortgageSteps || “Not calculated yet.

“; } else { s.style.display = “none”; a.style.transform = “rotate(0deg)”; } } function formatCurrency(n){ return currencySymbol + n.toFixed(2) + ” ” + fixedCurrency; }This mortgage refinance calculator helps you estimate your monthly payments on a second home when refinancing your loan.

Formula

Monthly Payment = (Loan Amount × Interest Rate) / (1 – (1 + Interest Rate)^(-Loan Term))

Example Calculation

Loan Amount: $250,000, Interest Rate: 3.5%, Loan Term: 30 years → Estimated Monthly Payment: $1,123.79

Why It Matters

Refinancing your second home can help reduce your interest rate, lower your monthly payment, or free up cash for other uses.

Smart Strategy

Ensure you are refinancing for the right reasons, such as lowering your interest rate, consolidating debts, or improving cash flow.

FAQs

How often can I refinance my second home? Generally, once every six months, but check with your lender for specific terms.

What factors affect my mortgage rate? Your credit score, loan amount, and loan term all play a role in determining your rate.