Home Mortgage Refinance Calculator (USA)

Home Mortgage Refinance Calculator

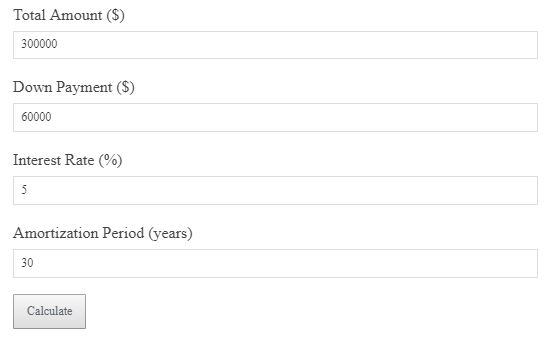

Calculate your potential monthly payments and savings when refinancing your mortgage.

Not calculated yet.

Loan Amount: ${formatCurrency(loanAmount)}

Interest Rate: ${(interestRate * 100).toFixed(2)}%

Loan Term: ${loanTerm} years

Current Monthly Payment: ${formatCurrency(currentMonthlyPayment)}

`; refinanceSteps += `Formulas:

Refinanced Payment = Loan Amount × Monthly Rate / (1 – (1 + Monthly Rate)^-Number of Payments)

Monthly Savings = Current Monthly Payment – Refinanced Payment

`; refinanceSteps += `Results:

Refinanced Monthly Payment: ${formatCurrency(refinancedPayment)}

Monthly Savings: ${formatCurrency(savings)}

`; refinanceSteps += `Tip: Lower interest rates or longer loan terms can significantly reduce your monthly payment.`; if(document.getElementById(“calculationStepsRefinance”).style.display === “block”){ document.getElementById(“calculationStepsRefinance”).innerHTML = refinanceSteps; } } function resetRefinance(){ document.querySelectorAll(“#calculator input”).forEach(el => el.value = “”); refinanceSteps = “”; document.getElementById(“calculationStepsRefinance”).innerHTML = “

Not calculated yet.

“; } function toggleRefinanceSteps(){ const s = document.getElementById(“calculationStepsRefinance”); const a = document.getElementById(“toggleArrowRefinance”); if(s.style.display === “none” || s.style.display === “”){ s.style.display = “block”; a.style.transform = “rotate(180deg)”; s.innerHTML = refinanceSteps || “Not calculated yet.

“; }else{ s.style.display = “none”; a.style.transform = “rotate(0deg)”; } } function formatCurrency(n) { return currencySymbol + n.toFixed(2) + ” ” + fixedCurrency; }This home mortgage refinance calculator helps you estimate how refinancing your mortgage will affect your monthly payments and potential savings.

- Home refinance calculator

- Mortgage refinancing savings estimator

- Refinance monthly payment calculator

- Mortgage loan refinance tool

Refinance Formula

Refinanced Monthly Payment = Loan Amount × Monthly Rate / (1 – (1 + Monthly Rate)^-Number of Payments)

Monthly Savings = Current Monthly Payment – Refinanced Monthly Payment

Example Calculation

$250,000 loan, 3.5% interest rate, 30-year term, $1,200 current payment → refinanced payment = $1,050, savings = $150 monthly.

Why It Matters

Refinancing can help reduce your monthly payments and potentially save you money in the long term.

Smart Strategy

Refinance if you can secure a lower interest rate or if you’re able to extend your loan term without significantly increasing the overall cost.

FAQs

How can I lower my refinance payment? By securing a lower interest rate or extending the loan term.

How much can I save by refinancing? The savings depend on the difference in interest rates and loan terms.

When should I refinance? If you qualify for a lower interest rate or if you’re looking to reduce your monthly payments.