Import Duty Calculator UK from Euros

Import Duty Calculator UK from Euros

Calculate the estimated import duty you would need to pay when importing goods into the UK from the Eurozone.

Not calculated yet.

Item Value: ${formatCurrency(itemValue)}

Shipping Cost: ${formatCurrency(shippingCost)}

Duty Rate: ${(dutyRate * 100).toFixed(1)}%

`; dutyCalculationSteps += `Formulas:

Customs Value = Item Value + Shipping Cost

Import Duty = Customs Value × Duty Rate

`; dutyCalculationSteps += `Results:

Customs Value: ${formatCurrency(customsValue)}

Import Duty: ${formatCurrency(importDuty)}

`; if(document.getElementById(“calculationSteps”).style.display === “block”){ document.getElementById(“calculationSteps”).innerHTML = dutyCalculationSteps; } } function resetCalculator(){ document.querySelectorAll(“#calculator input”).forEach(el => el.value = “”); dutyCalculationSteps = “”; document.getElementById(“calculationSteps”).innerHTML = “

Not calculated yet.

“; } function toggleCalculationSteps(){ const steps = document.getElementById(“calculationSteps”); const arrow = document.getElementById(“toggleArrow”); if(steps.style.display === “none” || steps.style.display === “”){ steps.style.display = “block”; arrow.style.transform = “rotate(180deg)”; steps.innerHTML = dutyCalculationSteps || “Not calculated yet.

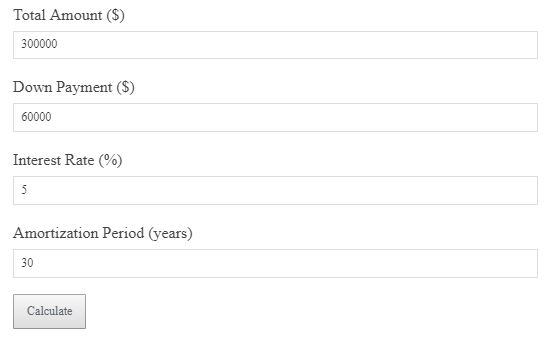

“; } else { steps.style.display = “none”; arrow.style.transform = “rotate(0deg)”; } } function formatCurrency(n){ return currencySymbol + n.toFixed(2) + ” ” + fixedCurrency; }This import duty calculator helps you estimate the customs duty when bringing goods into the UK from the Eurozone. The duty is calculated based on the value of the item and shipping cost.

- Import duty calculator UK

- Customs duty estimation tool

- Calculate UK import taxes

- Euro to UK import duties

Formula for Import Duty

Customs Value = Item Value + Shipping Cost

Import Duty = Customs Value × Duty Rate

Example Calculation

€1,000 item value, €50 shipping cost, 10% duty rate → Customs Value = €1,050, Import Duty = €105.

Why It Matters

Knowing your import duty is essential for budgeting when importing goods from the Eurozone to the UK.

Smart Strategy

Ensure you include all shipping costs when calculating the customs value for a more accurate estimate.

FAQs

What affects the import duty? The duty rate and total value of your goods, including shipping.

Do I pay duty on the shipping cost? Yes, the shipping cost is added to the item value when calculating the customs value.

Can I change the duty rate? No, the duty rate is determined by UK customs and varies by product type.