Second Home Mortgage Calculator UK

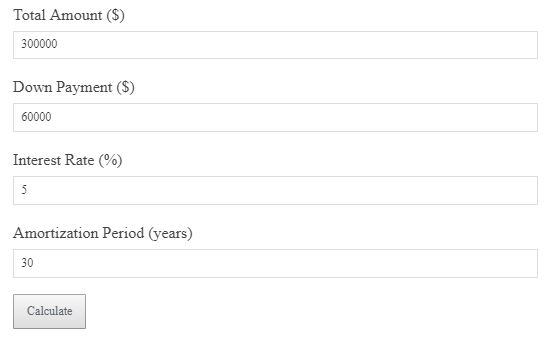

This second home mortgage calculator helps you estimate the monthly payments for a second home mortgage in the UK. Input the loan amount, interest rate, and loan term to get an accurate estimate.

- Second home mortgage calculator UK

- Mortgage affordability calculator

- UK home loan calculator

- Home loan comparison tool

Mortgage Formula

Monthly Payment = Loan Amount × Monthly Interest Rate / (1 – (1 + Monthly Interest Rate)^(-Number of Payments))

Example Calculation

£150,000 loan, 3.5% interest, 25-year term → Monthly Payment = £756.38.

Why It Matters

Knowing your mortgage payment helps you budget for your new home and make informed financial decisions.

Smart Strategy

Consider your ability to comfortably make the mortgage payments along with other living expenses before committing to a second home mortgage.

FAQs

What is the best mortgage term? Shorter terms usually mean higher monthly payments but less overall interest paid.

Can I change my mortgage term later? You may be able to refinance your mortgage for a different term.

What is a good interest rate? A competitive interest rate helps lower your monthly payments and the total cost of your loan.