Amortization Calculator with Extra Payments

Amortization Calculator

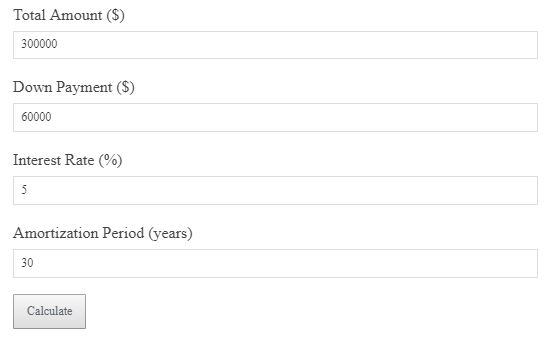

Use this calculator to determine how extra payments will affect your loan’s amortization schedule.

Not calculated yet.

Loan Amount: ${formatCurrency(loanAmount)}

Interest Rate: ${(interestRate*100*12).toFixed(2)}%

Term: ${loanTerm/12} years

Extra Payment: ${formatCurrency(extraPayment)}

`; amortizationSteps += `Results:

Monthly Payment: ${formatCurrency(monthlyPayment)}

Total Interest: ${formatCurrency(totalInterest)}

Term After Extra Payments: ${monthsSaved.toFixed(0)} months

`; amortizationSteps += `Tip: Extra payments can drastically reduce your loan term and interest paid over time. Consider making additional payments whenever possible.`; if(document.getElementById(“calculationStepsAmortization”).style.display===”block”){ document.getElementById(“calculationStepsAmortization”).innerHTML = amortizationSteps; } } function resetAmortization(){ document.querySelectorAll(“#calculator input”).forEach(el=>el.value=””); amortizationSteps=””; document.getElementById(“calculationStepsAmortization”).innerHTML=”

Not calculated yet.

“; } function toggleAmortizationSteps(){ const s=document.getElementById(“calculationStepsAmortization”); const a=document.getElementById(“toggleArrowAmortization”); if(s.style.display===”none”||s.style.display===””){ s.style.display=”block”;a.style.transform=”rotate(180deg)”; s.innerHTML=amortizationSteps||”Not calculated yet.

“; }else{s.style.display=”none”;a.style.transform=”rotate(0deg)”;} } function formatCurrency(n){return currencySymbol+n.toFixed(2)+” “+fixedCurrency;}This amortization calculator helps you determine the impact of extra payments on your loan’s amortization schedule. By entering your loan amount, interest rate, and term, you can see how making extra payments can shorten your loan term and reduce the total interest paid.

Amortization Formula

Monthly Payment = Loan Amount × (Interest Rate / (1 – (1 + Interest Rate)^(-Term)))

Example Calculation

$200,000 loan at 5% interest for 30 years, extra payment of $100 → Monthly payment: $1,073.64, Total interest: $186,512.18.

Why It Matters

Extra payments reduce your principal faster, which saves you money on interest over the life of the loan.

Smart Strategy

Consider making extra payments when you receive bonuses or tax refunds to pay off your loan quicker and save on interest.

FAQs

How do extra payments reduce my loan term? Each extra payment reduces the principal, which in turn reduces the amount of interest you pay over time, shortening the term.

Can I make extra payments on any loan? Most loans allow extra payments, but it’s important to check for any prepayment penalties or restrictions.