Bankrate’s Auto Loan Calculator – Style Match

Estimate monthly payment, total interest, and payoff time using loan amount, APR, term, and optional extras.

Not calculated yet.

Not calculated yet.

“; } function toggleSteps(){ const s=document.getElementById(“calculationSteps”); const a=document.getElementById(“toggleArrow”); if(s.style.display===”none”||s.style.display===””){ s.style.display=”block”; a.style.transform=”rotate(180deg)”; s.innerHTML = stepsLog || “Not calculated yet.

“; }else{ s.style.display=”none”; a.style.transform=”rotate(0deg)”; } } function calculateAutoLoan(){ stepsLog=””; const P_input = n(document.getElementById(“loanAmount”).value); const APR = n(document.getElementById(“apr”).value)/100; const y = n(document.getElementById(“termYears”).value); const m = n(document.getElementById(“termMonths”).value); const down = n(document.getElementById(“downPayment”).value); const tradeIn = n(document.getElementById(“tradeIn”).value); const taxPct = n(document.getElementById(“salesTax”).value)/100; const fees = n(document.getElementById(“fees”).value); const extra = n(document.getElementById(“extraPayment”).value); if(P_input<=0 || APR0.01 && monthCount<maxLoop){ const interest = (r===0)?0:balance*r; let principalPay = payment – interest; if(principalPaybalance){ principalPay = balance; } balance -= principalPay; totalInterest += interest; monthCount++; if(monthCount>1000 && r===0) break; } const payoffMonths = monthCount; const totalPaid = P + totalInterest; document.getElementById(“resultPayment”).value = fmt(scheduledPayment + extra); document.getElementById(“resultInterest”).value = fmt(totalInterest); document.getElementById(“resultTotal”).value = fmt(totalPaid); document.getElementById(“resultTerm”).value = `${payoffMonths} months (${(payoffMonths/12).toFixed(2)} yrs)`; stepsLog += `InputsVehicle Price/Loan Amount: ${fmt(P_input)}

APR: ${(APR*100).toFixed(3)}% | Term: ${term} months

Down: ${fmt(down)} | Trade-In: ${fmt(tradeIn)} | Fees: ${fmt(fees)} | Tax: ${(taxPct*100).toFixed(2)}%

Extra Monthly: ${fmt(extra)}

`; stepsLog += `Pre-Finance Math

Taxable Base = max(0, Price − Down − Trade-In) = ${fmt(taxableBase)}

Sales Tax = Base × Tax% = ${fmt(tax)}

Financed Principal P = Base + Tax + Fees = ${fmt(P)}

`; stepsLog += `Payment Formula

For r = APR/12 and n = months:

Payment = P × r × (1+r)n / ((1+r)n − 1)${r===0?” (r=0 ⇒ Payment = P/n)”:””}

`; stepsLog += `Results

Monthly Payment: ${fmt(scheduledPayment + extra)}

Total Interest: ${fmt(totalInterest)}

Total Cost (Principal + Interest): ${fmt(totalPaid)}

Expected Payoff: ${payoffMonths} months

Tip: Even a small extra payment can shave months off the term and reduce interest substantially. `; if(document.getElementById(“calculationSteps”).style.display===”block”){ document.getElementById(“calculationSteps”).innerHTML = stepsLog; } }

Use this Bankrate’s auto loan calculator–style tool to map out car payments before you visit the dealership. Enter your numbers, tweak the extras, and see how rate, term, tax, and fees shift the math.

- bankrate’s auto loan calculator

- auto loan payment estimator

- vehicle financing calculator with taxes and fees

- extra payment auto amortization

How the Formula Works

For monthly interest rate r = APR/12 and number of months n, the standard installment formula is:

Payment = P × r × (1+r)n / ((1+r)n − 1) (if r=0, then Payment = P/n).

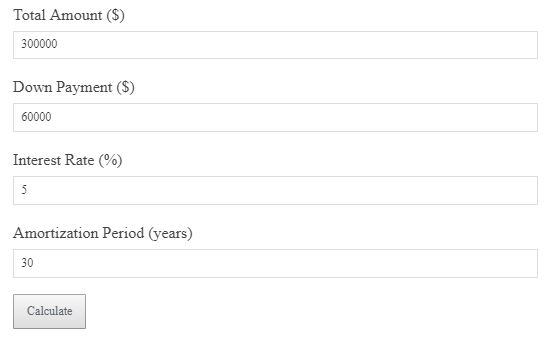

Worked Example

Suppose the vehicle price proxy is $28,000, with $2,000 down and $1,000 trade-in. Sales tax is 8% and fees are $400. APR is 5.99% for 60 months.

Taxable base = $28,000 − $2,000 − $1,000 = $25,000; tax = $2,000; financed principal = $27,400. The payment using the formula is about $530/month. Adding $50/month extra can cut ~5–7 months off the schedule depending on rounding.

Optimization Tips

Shorter terms cost less interest overall, even if the monthly payment is higher. Extra payments directly attack principal; be sure your lender applies them correctly. Down payment or trade-in reduces taxable base and the amount financed.

FAQs

Does sales tax belong in the loan? Many buyers roll sales tax and fees into the loan; this calculator supports either case via the inputs provided.

What if APR changes? Rates are volatile. Re-run scenarios with slightly higher/lower APR to see sensitivity.

How do extra payments affect payoff? Extra principal shortens the term non-linearly, especially early on.

关键词灵感与布局风格参考自保险/车辆类计算器页面与关键词清单,以确保搜索可发现性与一致的两栏结构。 :contentReference[oaicite:0]{index=0} :contentReference[oaicite:1]{index=1}