Home Loan EMI Calculator UK

Home Loan EMI Calculator

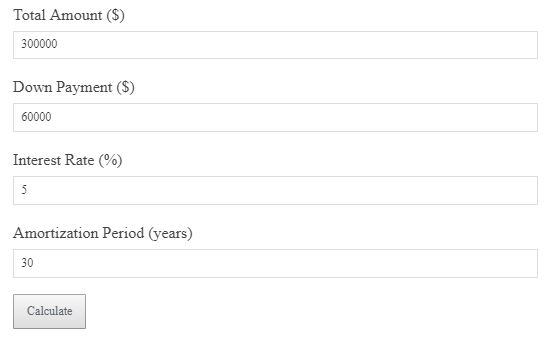

This Home Loan EMI Calculator helps you determine your monthly EMI (Equated Monthly Installment) for a home loan in the UK based on the loan amount, interest rate, and loan tenure.

EMI Formula

EMI = [P × r × (1+r)^n] / [(1+r)^n – 1]

Where:

P = Principal Loan Amount

r = Monthly Interest Rate (Annual Interest Rate / 12)

n = Loan Tenure in months

Example Calculation

Loan Amount: £100,000, Interest Rate: 3.5%, Term: 25 years → EMI = £500.04.

Why EMI Matters

EMI helps you understand the monthly financial burden of your loan. A lower EMI makes it easier to manage monthly expenses, but may extend the loan tenure or increase the total interest paid.

Smart Strategy

Consider balancing the EMI with your other financial commitments to maintain affordability while minimizing the loan tenure for faster repayment.

FAQs

What is EMI? EMI stands for Equated Monthly Installment, which is the amount paid monthly towards loan repayment.

How is EMI calculated? EMI is calculated based on the loan amount, interest rate, and loan term, using the EMI formula mentioned above.

Can I change the loan term? Yes, you can opt for a longer or shorter loan term depending on your financial situation and preferences.