Mortgage Calculator for Excel

Mortgage Payment Calculator

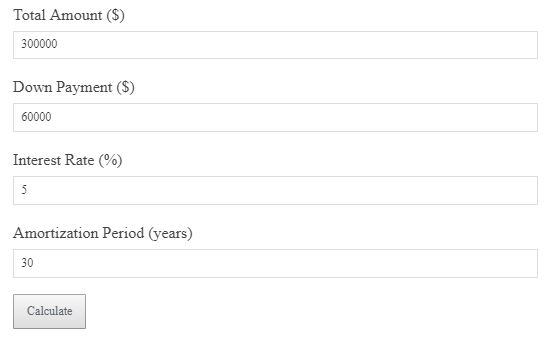

Use this calculator to estimate your monthly mortgage payments based on your loan amount, interest rate, and loan term.

Not calculated yet.

Loan Amount: ${formatCurrency(loanAmount)}

Interest Rate: ${interestRate * 100}%

Loan Term: ${loanTerm / 12} years

`; mortgageSteps += `Formulas:

Monthly Payment = Loan Amount × (Interest Rate / (1 – (1 + Interest Rate)^(-Loan Term)))

`; mortgageSteps += `Results:

Monthly Payment: ${formatCurrency(monthlyPayment)}

`; if(document.getElementById(“calculationStepsMortgage”).style.display===”block”){ document.getElementById(“calculationStepsMortgage”).innerHTML = mortgageSteps; } } function resetMortgage(){ document.querySelectorAll(“#calculator input”).forEach(el => el.value = “”); mortgageSteps = “”; document.getElementById(“calculationStepsMortgage”).innerHTML = “

Not calculated yet.

“; } function toggleMortgageSteps(){ const s = document.getElementById(“calculationStepsMortgage”); const a = document.getElementById(“toggleArrowMortgage”); if(s.style.display === “none” || s.style.display === “”){ s.style.display = “block”; a.style.transform = “rotate(180deg)”; s.innerHTML = mortgageSteps || “Not calculated yet.

“; } else { s.style.display = “none”; a.style.transform = “rotate(0deg)”; } } function formatCurrency(n) { return currencySymbol + n.toFixed(2) + ” ” + fixedCurrency; }This mortgage calculator helps you estimate your monthly payments based on the loan amount, interest rate, and loan term entered in the form.

- Mortgage payment calculator

- Loan affordability estimator

- Excel-based mortgage calculator

- Home loan payment estimator

Mortgage Calculation Formula

Monthly Payment = Loan Amount × (Interest Rate / (1 – (1 + Interest Rate)^(-Loan Term)))

Example Calculation

For a $300,000 loan, 3.5% interest rate, and 30-year term, the monthly payment would be $1,347.13.

Why It Matters

Knowing your monthly payment helps you understand how your loan terms affect your budget and long-term finances.

Smart Strategy

Adjusting the loan amount or term can help you find a balance between your payment amount and interest cost.

FAQs

What loan term is best? It depends on your budget and financial goals. A shorter term means higher payments but lower interest costs.

Can I adjust the interest rate? Typically, the rate is fixed for a period, but it can be changed if you refinance.