Online BA 2 Plus Calculator

BA 2 Plus Financial Calculator

Perform financial calculations using the popular BA 2 Plus calculator format. Enter your values to compute time value of money, loan amortization, and more.

Monthly Quarterly AnnuallyNot calculated yet.

Principal: ${formatCurrency(principal)}

Interest Rate: ${(interest * 100).toFixed(1)}%

Loan Term: ${term} years

Payment Frequency: ${frequency}

`; ba2plusSteps += `Formula:

Payment = Principal × (Monthly Interest Rate) / (1 – (1 + Monthly Interest Rate) ^ -Number of Payments)

`; ba2plusSteps += `Results:

Monthly Payment: ${formatCurrency(payment)}

`; ba2plusSteps += `Tip: Adjusting the loan term or interest rate can significantly affect your monthly payments.`; if (document.getElementById(“calculationStepsBA2Plus”).style.display === “block”) { document.getElementById(“calculationStepsBA2Plus”).innerHTML = ba2plusSteps; } } function resetBA2Plus(){ document.querySelectorAll(“#ba2plus_calculator input, #ba2plus_calculator select”).forEach(el => el.value = “”); ba2plusSteps = “”; document.getElementById(“calculationStepsBA2Plus”).innerHTML = “

Not calculated yet.

“; } function toggleBA2PlusSteps(){ const s = document.getElementById(“calculationStepsBA2Plus”); const a = document.getElementById(“toggleArrowBA2Plus”); if (s.style.display === “none” || s.style.display === “”) { s.style.display = “block”; a.style.transform = “rotate(180deg)”; s.innerHTML = ba2plusSteps || “Not calculated yet.

“; } else { s.style.display = “none”; a.style.transform = “rotate(0deg)”; } } function formatCurrency(n) { return currencySymbol + n.toFixed(2) + ” ” + fixedCurrency; }The BA 2 Plus financial calculator helps you compute a variety of financial calculations, from loan amortization to time value of money, all in an easy-to-use online tool.

- BA 2 Plus financial calculator

- Loan payment estimator

- Time value of money calculator

- Loan amortization tool

How It Works

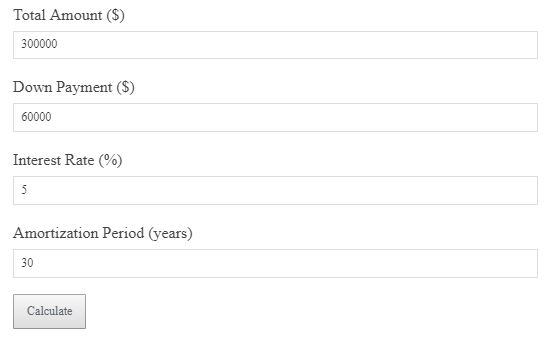

Simply enter your principal amount, interest rate, loan term, and payment frequency to calculate the monthly payment for your loan.

Example Calculation

$10,000 loan at 5% interest over 10 years → Monthly payment = $106.07.

Why It Matters

Understanding how loan terms and interest rates affect your payments can help you make better financial decisions.

Smart Strategy

Use the calculator to compare different loan terms and interest rates to find the best financial option for you.

FAQs

What is the best loan term? Shorter loan terms tend to have higher monthly payments but lower total interest costs over time.

Can I change my payment frequency? Yes, you can choose monthly, quarterly, or annual payments based on your preferences.